Risk Contagion Effects of Interconnected Manufacturing Enterprises

Introduction

Energy Engineering is an ever-evolving field that intersects with multiple aspects of modern industries, including the critical manufacturing sector. A recent study published in IgMin Research has highlighted the pressing challenges faced by interconnected manufacturing enterprises due to financial risk contagion, which bears remarkable similarities to the spread of infectious diseases. This blog post delves into the study’s findings and explores how Energy Engineering principles can contribute to risk mitigation and sustainable growth.

The Critical Role of Manufacturing Enterprises in the Economy

Manufacturing enterprises form the backbone of many economies, contributing significantly to GDP and employment. In countries like China, these enterprises account for over 27.7% of the national economy. However, their interconnectedness—characterized by complex supply chains and financial dependencies—makes them vulnerable to systemic risks.

The research conducted by Ming, Xuefeng, Lnzi, and Ning examines how financial risks spread within this sector. It employs advanced modeling techniques, such as the SEIRS epidemiological model, to simulate risk transmission patterns. This approach reveals that financial risk contagion in manufacturing enterprises can escalate rapidly, akin to the outbreak of infectious diseases like SARS.

Key Findings of the Study

- Risk Transmission Mechanisms: The study identifies excessive inter-company loans and fragile capital chains as primary catalysts for financial risk contagion. Manufacturing enterprises with weaker financial resilience act as conduits for risk spread, affecting the entire ecosystem.

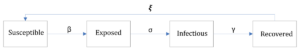

- Dynamic Modeling with SEIRS: By adapting the Susceptible-Exposed-Infectious-Recovered-Susceptible (SEIRS) model, the researchers demonstrated how financial vulnerabilities propagate. This model highlights the critical parameters influencing risk spread, including transmission rates, recovery rates, and immunity durations.

- Role of Policy and Regulation: Effective regulatory frameworks and government interventions can curb the spread of financial risks. The study emphasizes the importance of proactive measures, such as financial risk early warning systems and stress testing mechanisms.

Figure 1: SEIRS Model Transmission Diagram

Figure 1: SEIRS Model Transmission Diagram

Implications for Energy Engineering

The findings have profound implications for Energy Engineering, particularly in designing resilient systems and sustainable processes for manufacturing enterprises. Here are key takeaways:

Enhancing Risk Mitigation Strategies

Energy Engineering can integrate advanced analytics and predictive models into industrial processes to anticipate and mitigate risks. For instance, digital twins and real-time monitoring systems can detect early signs of financial or operational stress, allowing timely interventions.

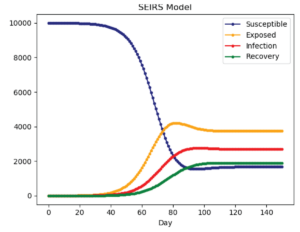

Figure 2: Curve0 Initial state

Figure 2: Curve0 Initial state

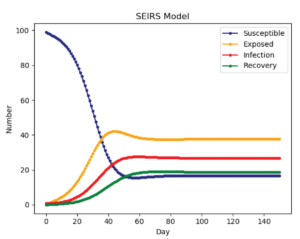

Figure 3: Curve1 Reduce the number of businesses

Figure 3: Curve1 Reduce the number of businesses

Promoting Sustainable Practices

Sustainability is a cornerstone of Energy Engineering. Implementing energy-efficient technologies and circular economy principles can reduce costs and improve the financial stability of manufacturing enterprises, making them less susceptible to systemic risks.

Leveraging Technology for Resilience

The convergence of Energy Engineering with emerging technologies, such as artificial intelligence and blockchain, offers innovative solutions for risk management. AI can optimize energy usage and identify vulnerabilities, while blockchain ensures transparency and trust in financial transactions.

Recommendations for the Manufacturing Sector

Drawing from the study’s insights and Energy Engineering principles, the following recommendations can help manufacturing enterprises navigate financial risks:

- Strengthen Financial Ecosystems: Establish robust credit assessment systems and enforce stricter lending practices to prevent excessive inter-company loans.

- Adopt Smart Energy Solutions: Utilize energy-efficient technologies and renewable energy sources to reduce operational costs and improve financial resilience.

- Implement Comprehensive Monitoring Systems: Deploy real-time monitoring tools to track financial health and energy usage, enabling early detection of risks.

- Encourage Government and Industry Collaboration: Develop public-private partnerships to support at-risk enterprises and enhance the overall stability of the manufacturing sector.

Conclusion

The intersection of Energy Engineering and financial risk management presents a unique opportunity to transform the manufacturing sector. By embracing innovative technologies and sustainable practices, enterprises can build resilience against systemic risks while contributing to economic and environmental sustainability. The lessons from the IgMin Research study underscore the importance of proactive measures and collaboration in addressing the challenges of financial contagion.

For more insights into the transformative role of Energy Engineering, explore the full study here or download the detailed PDF here.